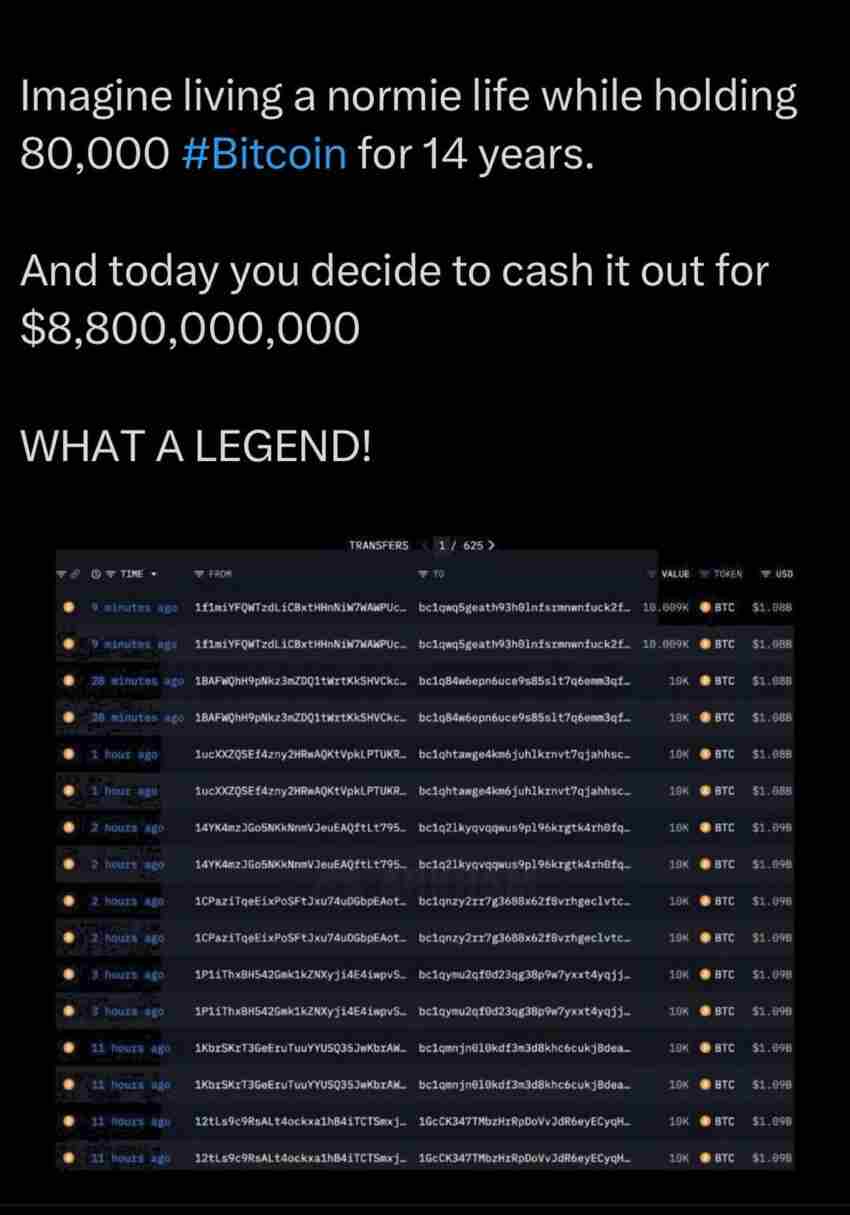

Eight Bitcoin Wallets Move 80,000 BTC made headlines today. First of all, this news signals massive shifts in crypto holdings. In addition, smart money appears on the move.

Moreover, token flows of this scale rarely go unnoticed. As a pro audience, you need insights. In addition, you need clear context. First of all, we will unpack what these transfers mean. Moreover, we will explain how to track such movements. Finally, you will learn actionable tactics.

What Does “Eight Bitcoin Wallets Move 80,000 BTC” Mean?

First of all, we decode the headline. In addition, we highlight real data. Moreover, we show why it matters.

1.️ Exceptional Bitcoin Wallet Activity

Eight Bitcoin wallets each moved significant sums. Moreover, the total reached 80,000 BTC. These are whale‑level transfers. In addition, they may signal market shifts.

2. Timing and Context

First of all, the timing aligned with on‑chain rallies. Moreover, several crypto analysts flagged the moves. In addition, it coincided with rising institutional interest.

3. Market Impact Eight Bitcoin Wallets Move 80,000 BTC

Such big transfers spark speculation. In addition, price swings often follow. Moreover, speculative traders observe patterns. These moves can foreshadow bull runs or corrections.

Examples: When “Eight Bitcoin Wallets Move 80,000 BTC” Happened Before

Let’s dive deeper. We show real cases.

Example A: Whale Transfers in Early 2025 first is this momentum “Eight Bitcoin Wallets Move 80,000 BTC”

In February 2025, eight wallets moved ~50,000 BTC. First of all, that raised alerts in the tracking community. In addition, on‑chain metrics showed rising activity. Moreover, short‑term price volatility followed.

Recommended by Nova News:

Example B: 2022–2023 Precedents

During the 2022–2023 bear‑to‑bull shift, several rounds of whale movements occurred. Eight‑wallet groups moved 60K–90K BTC each time. First of all, these convulsions shaped market sentiment. Moreover, on‑chain analytics firms documented them.

How to Track When “Eight Bitcoin Wallets Move 80,000 BTC”

Next, let’s get educational. You can track these mega‑transfers yourself.

1. Choose Reliable On‑Chain Analytics Tools for tracking Eight Bitcoin Wallets Move 80,000 BTC

First of all, you need platforms like Glassnode, Chainalysis, or Arkham. In addition, they surface large wallet transfers. Moreover, they show wallet clusters by size.

- Glassnode: Alerts for 1,000+ BTC transfers.

- Chainalysis Reactor: Tracing footpaths of wallet clusters.

- Arkham: Labels wallets and highlights big moves.

2. Set Alerts for Whale‑Level Transfers

In addition, configure notifications for 5,000+ BTC moves. First of all, these thresholds capture whale activity. Moreover, you can export charts and timestamps.

3. Analyze Flow Direction

Next, see if BTC is inbound to exchanges. Moreover, you can check addresses flagged as cold‑storage. First of all, large transfers to exchanges may indicate intent to sell. In addition, cold‑storage movement may signal accumulation.

4. Correlate with Price and Sentiment

First of all, overlay whale‑move timestamps with price action. Moreover, measure sentiment via Twitter, Reddit, Messari. In addition, this helps you spot timing patterns.

Pro Tips When “Eight Bitcoin Wallets Move 80,000 BTC”

Also, here are expert strategies once you spot such moves:

Tip 1: Confirm with Multiple Data Providers

First of all, don’t rely on one tool. In addition, corroborate with at least two on‑chain platforms.

Tip 2: Observe Exchange Flows

Moreover, track direction—exchange inbound vs. outbound. First of all, inbound flows often precede sell‑off pressure. Outbound flows suggest hodling.

Tip 3: Time Your Entry/Exit

In addition, consider micro‑timing. For example, buy the dip if whales are accumulating. First of all, take profits if they are moving funds back in.

Tip 4: Use Derivatives for Hedging

Moreover, use future contracts or options if you’re advanced. First of all, hedge while whales move large sums.

Tip 5: Consider Security Upgrades

In addition, the move may reflect a security upgrade, not a sale. According to Arkham, the 80,000 BTC shifted to modern bc1q‑style SegWit addresses for better safety and lower fees.

First of all, always migrate old legacy (1‑prefix) keys to SegWit or bech32. Moreover, this is critical if funds originated in the Satoshi era (2009–2011). In addition, it protects against future vulnerabilities.

Tip 6: Look for OP_RETURN Legal Notices before to make the move like “Eight Bitcoin Wallets Move 80,000 BTC”

Moreover, Ledger’s CTO highlighted that OP_RETURN legal notices were sent to legacy wallets before transfers.

First of all, these might signal threats or claims. In addition, if you hold legacy keys, check for unusual on‑chain messages. Moreover, legal warnings may prompt proactive moves, not market dumps.

Tip 7: Watch for Pre‑Transfers on Other Chains

In addition, a suspicious Bitcoin Cash (BCH) test transaction occurred prior to the BTC transfer.

First of all, this may indicate a private‑key test before moving larger amounts. Moreover, always monitor related assets when large migrations occur.

What “Eight Bitcoin Wallets Move 80,000 BTC” Reveals

1. A Record‑Shattering Reawakening from the Satoshi Era

First of all, this is the largest single‑day movement of coins held since Bitcoin’s earliest phase. In addition, each wallet had exactly 10,000 BTC from April or May 2011.

2. Calm Market Despite $8.6B Shift

Moreover, despite the $8.6 billion impact, the market dipped only ~1.3% before bouncing back. First of all, this shows robust liquidity and maturity of today’s crypto markets.

3. Ownership Theories: From Roger Ver to Quantum Hack

In addition, analysts speculate about ownership. First of all, some name Roger Ver—an early investor—based on timing and size.

Moreover, others point to a post‑mortem key recovery or inheritance plan. In addition, quantum‑attack theories also surfaced. But experts dismiss them due to lack of evidence.

4. Lessons on Long‑Term Key Storage

First of all, maintaining private keys for 14+ years is remarkable. In addition, this event underscores the need for secure backups, hardware wallets, and periodic upgrades. Moreover, the switch to SegWit shows continuous vigilance matters.

Educational Guide: How to Protect and Move Satoshi‑Era Coins

Let’s walk through an action‑oriented, step‑by‑step guide.

Step 1: Inventory Your Legacy Wallets

First of all, list legacy (1‑prefix) wallets from 2009–2013. In addition, verify their balances using block explorers.

Step 2: Migrate to Secure Formats

First of all, create a SegWit (bc1q) wallet via a trusted provider. Moreover, ensure the address supports bech32 format to reduce fees and boost security.

Step 3: Test with a Small Transaction

In addition, mimic the whale’s method: send a small amount—maybe a few hundred USD worth. First of all, confirm receipt and integrity before moving the full balance.

Step 4: Move Entire Balance in One Go

First of all, once a test succeeds, transfer fully. In addition, target a single bc1q address to simplify management. Moreover, send directly to cold storage or hardware wallets.

Step 5: Monitor After Transfer

First of all, track the new address for unexpected activity. In addition, set alerts for on‑chain messages like OP_RETURN. Moreover, stay vigilant if legal notices appear.

Recommended by Nova News:

Final Thoughts

Eight Bitcoin Wallets Move 80,000 BTC, it’s not just a headline. First of all, it’s a statement on history, security, and market confidence. Moreover, these moves originate from Satoshi‑era wallets, each holding 10,000 BTC since 2011. In addition, the funds shifted to modern bc1q‑SegWit addresses likely for security upgrades, not sales.

First of all, take proactive steps if you hold legacy coins: inventory, test, upgrade, and secure. In addition, remain aware of on‑chain signals, like BCH tests or OP_RETURN legal flags. Moreover, combine data from platforms like Arkham to confirm activity. Ultimately, tracking large Eight Bitcoin Wallets Move 80,000 BTC shifts arms you with insights—and peace of mind.

You must to learn that when Eight Bitcoin Wallets Move 80,000 BTC, the market watches. In addition, it sparks volatility and sentiment swings. Moreover, tracking these movements gives you actionable insight.

First of all, set up on‑chain alerts. In addition, confirm with reliable platforms. Moreover, analyze direction and correlation. Above all, tailor your trades. In addition, keep active voice and short sentences as you read on.

Please don’t forget like and share this post on social media if have some value for you. Thank you for reading.